Quantum Clusters: Ranking the World’s Deep-Tech Epicentres

Published By: Fredrik Erixon Andrea Dugo Dyuti Pandya Elena Sisto

Research Areas: Data, AI, and Emerging Technologies Innovation, IP, and Human Capital Trade, Globalisation and Security

Summary

The ECIPE Quantum Project has so far laid the groundwork for understanding the global quantum landscape. It introduced the fundamentals of quantum technologies, assessed national activity in investment, scientific output, and patents, and charted international collaboration patterns to show that progress relies as much on shared expertise as on scientific breakthroughs. This work has now led to the next phase: identifying the innovation hubs within each country where meaningful quantum advances occur – what we call quantum clusters.

Quantum R&D requires ultra-specialised, capital-intensive infrastructure that cannot easily be duplicated. The talent pool is also extremely scarce and concentrated in a small number of physics and engineering groups, creating inherent geographic bottlenecks. Combined with long pre-commercial timelines and immature supply chains, these constraints mean that genuine quantum innovation emerges only where specific capabilities and institutions co-locate. At the same time, the overwhelming complexity of the technology demands extensive inter-regional networking for knowledge integration. Therefore, the successful quantum cluster is not a self-contained hub, but the most effective node in a global and distributed network. This makes quantum clusters especially important for policies aimed at strengthening coordination across industry, research, and government, both locally and globally.

This paper presents the first structured ranking of quantum clusters – not to reinforce narratives of supremacy, but to showcase high-performing regions, revealing where real capabilities lie and where gaps persist. This analysis offers a clearer basis for designing targeted policy interventions in investment attraction, talent development, and infrastructure planning. Viewing quantum through a cluster lens can help policymakers understand the external, institutional, and firm-level factors that shape quantum competitiveness, enabling more integrated strategies and stronger collaboration among stakeholders.

In this report, we distinguish between quantum clusters and quantum quasi-clusters.

A quantum cluster is a geographically concentrated ecosystem of startups, corporations, universities, research institutes, and government agencies that meets minimum thresholds of:

- Startup funding: a cluster qualifies as such if it hosts either at least two startups with USD 10 million or more in disclosed funding combined, or at least one startup with USD 25 million or more.

- Institutional presence: in addition, a cluster needs to be home to at least five institutions – research, industry, or government – that are actively engaged in quantum activities.

A quantum quasi-cluster is a geographic area where quantum activity is beginning to take shape but has not yet reached the critical mass required to function as a mature, self-sustaining innovation hub. It typically lacks a sufficient concentration of institutions and/or the presence, or substantial funding, of a quantum startup. As a result, it shows early potential but does not yet display the density and breadth characteristic of a fully developed quantum cluster.

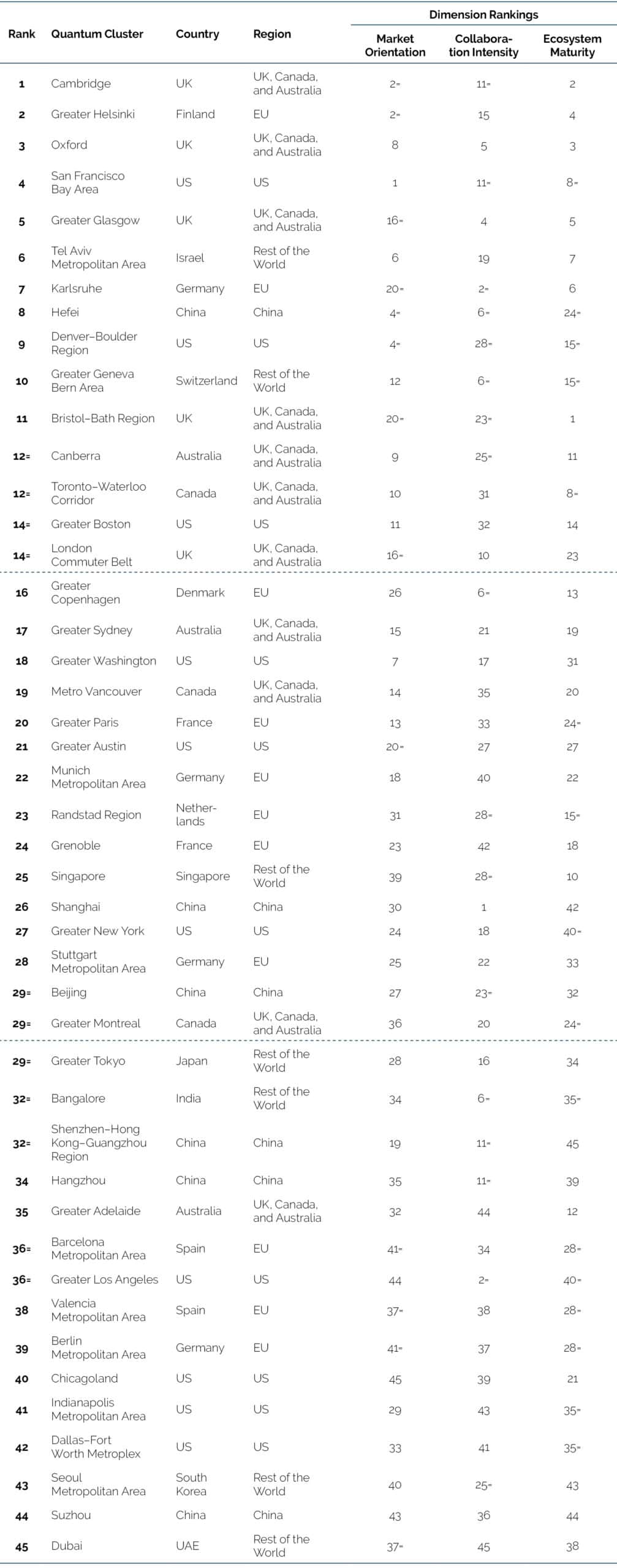

This study identifies and ranks 45 quantum clusters worldwide (see Table A below). These regions are the most likely to shape future outcomes in the global quantum landscape, as they offer the most favourable conditions for sustained innovation and high productivity in quantum.

The final ranking reflects the average of the scores across three dimensions; each built from three underlying indicators:

- Dimension 1: Market Orientation – assesses how much a cluster’s quantum activity is geared towards commercialisation. It reflects the scale and intensity of investment in quantum firms and the degree of industry participation in quantum collaborations.

- Dimension 2: Collaboration Intensity – measures how actively and strategically a cluster engages in partnerships. This dimension captures the volume of collaborations, the openness to international partnerships, and the cluster’s role as a connector within the global quantum network.

- Dimension 3: Ecosystem Maturity – evaluates the institutional foundation and productivity of the local innovation environment. It measures how well quantum-active institutions are integrated and capable of sustaining long-term quantum growth.

Based on these three dimensions, Cambridge (UK) leads the global ranking, followed closely by Greater Helsinki (Finland), Oxford (UK), the San Francisco Bay Area (US), and Greater Glasgow (UK). The top 5 reflects the continued dominance of established academic and technology ecosystems in the UK and the US. More broadly, the English-speaking world accounts for 10 of the top 15 clusters, including hubs in Australia (Canberra) and Canada (Toronto–Waterloo). The EU places two clusters in the top third – Helsinki and Karlsruhe – while Israel (Tel Aviv), China (Hefei), and Switzerland (Greater Geneva–Bern Area) each contribute one.

The middle third of the ranking is more geographically diverse. Strong European ecosystems such as Copenhagen, Paris, the Randstad Region, and Munich appear here, along with China’s Beijing and Shanghai clusters. These ecosystems demonstrate rapid scientific activity but generally lag behind Anglophone peers in commercialisation outcomes.

The lower third consists of less developed clusters still building institutional capacity, market pipelines, and international linkages. Chinese clusters such as Shenzhen–Hong Kong–Guangzhou, Hangzhou, and Suzhou remain comparatively less mature in institutional engagement. Similarly, clusters in Spain and Berlin show promising research capabilities but face constraints in scale and industry participation. Emerging ecosystems in Bangalore, Dubai, and Seoul represent important entry points for quantum research and entrepreneurship but currently operate at a smaller scale than more established leaders.

We assess cluster performance across three dimensions because different features demand different policy responses. A cluster excelling in research but weak in industry engagement requires a different strategy from one with strong funding but limited collaboration. Analysing each dimension highlights what drives performance and where interventions are most needed.

This report also identifies 86 quantum quasi-clusters globally. We do not rank them in the same detail, as they still lack the necessary components, but we assess their potential and group them into two tiers based on their proximity to becoming full clusters.

Table A: Quantum Clusters Ranking Source: ECIPE Quantum Database.

Source: ECIPE Quantum Database.